2026 HealthJoy - ALL Team Members

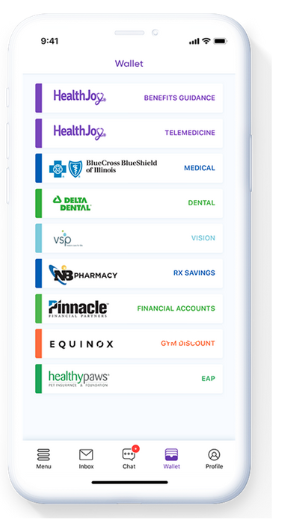

HealthJoy is the virtual access point for all your healthcare navigation and team member benefits needs. Visit go.healthjoy.com/activate to get started.

The HealthJoy app is available for all Jim Ellis team members. It includes a summary of all of your Jim Ellis benefits along with helpful tools and resources to maximize your health.

Use the HealthJoy app as follows:

- Personalized benefits wallet: You’ll have access to all of your Jim Ellis benefits at your fingertips, including dental, vision, life insurance, disability, and more through the HealthJoy portal.

- Teladoc access for you and your family members: Teladoc provides zero-cost access to licensed physicians for non-complex illnesses and injuries.

- 24/7 healthcare concierge team

- Even if you are not enrolled in the Jim Ellis medical plan, HealthJoy provides several health-related resources for you.

- Find healthcare providers with the “Find Care” tool: You can find participating primary care physicians and specialists conveniently through the convenient HealthJoy app. As a reminder, Jim Ellis medical plan members use Garner Health as your first stop to access high-quality healthcare providers and get up to $5,000 individual / $10,000 family (Team Member + Dependents) in free care.

- Pharmacy savings tool: This tool helps you find lower-cost medication alternatives, saving you money.

- Health cost estimation: HealthJoy provides cost and quality transparency to help with your medical care shopping needs.

HealthJoy Mobile App

Personalized Benefits Wallet

- The wallet includes convenient access to your dental, vision, Flexible Spending Account (FSA), life insurance, disability, critical illness, accident, identity theft, and pet insurance benefits.

- Includes plan summaries, benefits descriptions, and plan contact information

- Includes links to locate participating providers for dental and vision coverages.

Pharmacy Savings Tool

- Compare prices quickly and easily by searching local pharmacies for the best discounts.

- Get free coupons on your medications, saving you money. Simply present the coupon to your pharmacist to receive the discount at the time of purchase.

Ask a Health Concierge

- Chat with Joy, your virtual Healthcare Concierge.

- Get provider, lab, and facility recommendations for a procedure.

- Ask general healthcare questions for guidance and assistance.

- These services also apply for team members not enrolled in medical coverage.

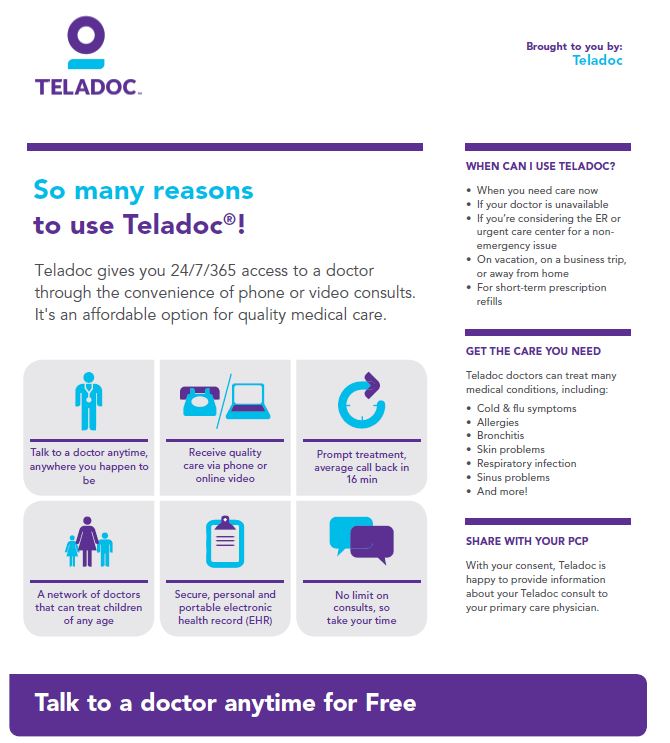

Teladoc

- Beginning January 1, 2026, access the free Teladoc benefit through HealthJoy.

- Speak with a licensed physician for help with non-complex illnesses and injuries.

Find Healthcare Tool

- Search for top-quality healthcare providers in your area.

- Access primary care physicians, including general practice, family practice, internal medicine, and pediatrician doctors.

- You may also access high-quality specialist recommendations through the Find Care tool.

- These recommended physicians have superior clinical outcomes and high scores for overall cost-effectiveness.

- These services also apply for team members not enrolled in medical coverage.

Download the HealthJoy App

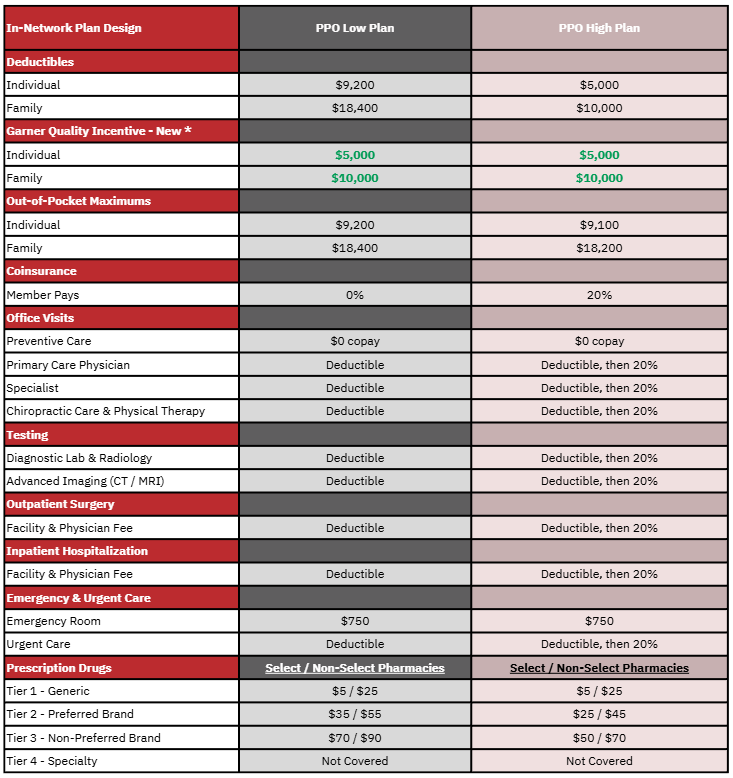

2026 Medical

For the 2026 plan year, you will choose between the PPO Low Plan and the PPO High Plan, using the Cigna PPO network. We have a new free Garner benefit that helps you find the highest quality doctors while saving you up to $5,000 individual / $10,000 family in healthcare costs. This benefit is included for both medical plan options. There are no changes in team member premiums for 2026. There are also updates to the prescription drug benefits for 2026 with VeracityRx as the new pharmacy benefits provider.

In-network preventive care services, such as annual check-ups, are covered in full for both plans. As a reminder, these services need to be coded as preventive to be paid in full by the plan.

The medical plans are administered by Nova Healthcare. Nova Healthcare processes your claims and eligibility updates. HealthJoy, your healthcare guidance app, helps improve your healthcare experience while saving you time and money. We encourage all medical plan members to use the HealthJoy app when you need medical services.

Although the plans include out-of-network coverage, your costs are significantly lower if you remain in the Cigna PPO network. You may access Cigna PPO network information by using the HealthJoy mobile app or on Nova’s website.

In-Network Medical Summary

*Emergency room and prescription drug benefits are not eligible for the Garner high-quality incentive.

Other Benefit Summary Notes

- Higher out-of-pocket costs for out-of-network services.

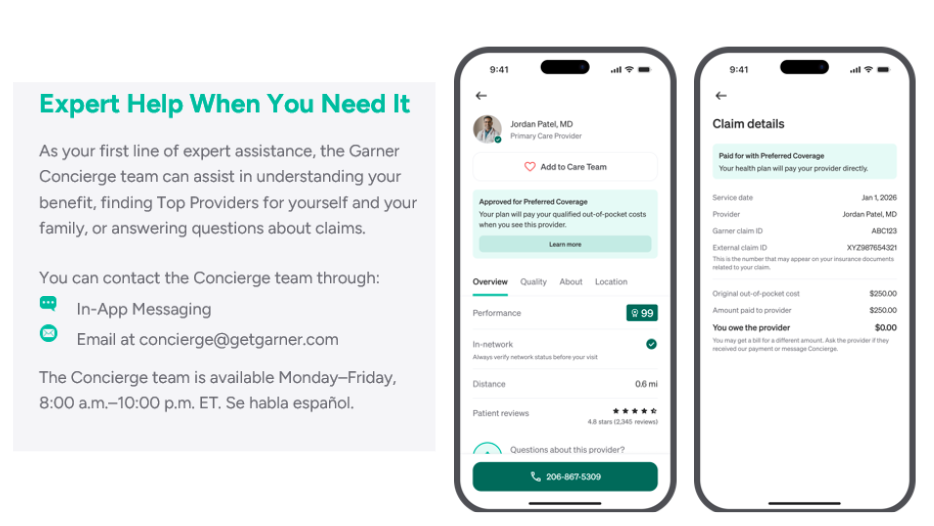

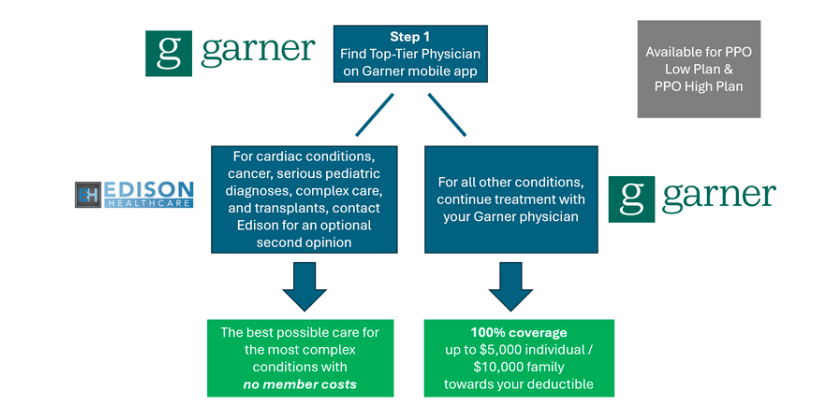

New Quality-Incentive Benefit

Garner Health is a new free benefit that helps you find the highest quality doctors while saving you money. For both plan options, when you use the Garner app, find a recommended doctor, and visit that doctor, you will receive 100% coverage! Emergency room visits and prescription drugs are not eligible for the Garner incentive benefit.

The best doctors are often the least expensive. Missed diagnoses, unnecessary surgeries, and bad health outcomes are costly. By setting you up with the best doctors, you not only get better care, but the cost is lower for both you and Jim Ellis. As a result, Jim Ellis covers your medical bills when you use Garner.

Team members receive up to $5,000 individual and $10,000 dependent(s) when you visit a top-tier provider. Garner can be used for all kinds of care:

- Primary Care Physicians and Specialists

- Simple labwork and diagnostics

- As long as a top-tier physician orders the test, it will be covered, regardless of which lab is used.

- For invasive labwork and complex imaging, like MRI or CT, these services will be covered if they are provided by a Garner approved provider.

- Search by type of provider, procedure, or condition

- Click "Find Care" in the app and type what you are looking for.

- Examples: colonoscopy, MRI, lower back pain, hand surgery, pinched nerve, sleep apnea, etc.

- Physicians Assistants (PAs) and Nurse Practitioners

- If you have an appointment with an approved doctor and a nurse practitioner in their practice sees you instead, the costs from that visit will be eligible for the incentive. Even if it is after your service date, message the Concierge through the Garner Health app and ask to have the PA or nurse practitioner added to your Care Team.

- Nurse Practitioners and Physicians Assistants are not listed in the Garner app. Contact the Garner Concierge to confirm whether your Nurse Practitioner is approved for the benefit. If they practice under a Garner approved, provider, the Concierge can add them to your Care Team.

How It Works

- A member must use Garner to get a recommendation before visiting the provider.

- Visit the provider recommended by Garner and provide your Medical ID Card at the time of service.

- Since most services are subject to the deductible, your doctor should not bill you at the time of service.

- Following your medical service, the claim will be processed by Nova, and the Garner incentive benefit will be applied before calculating your patient responsibility.

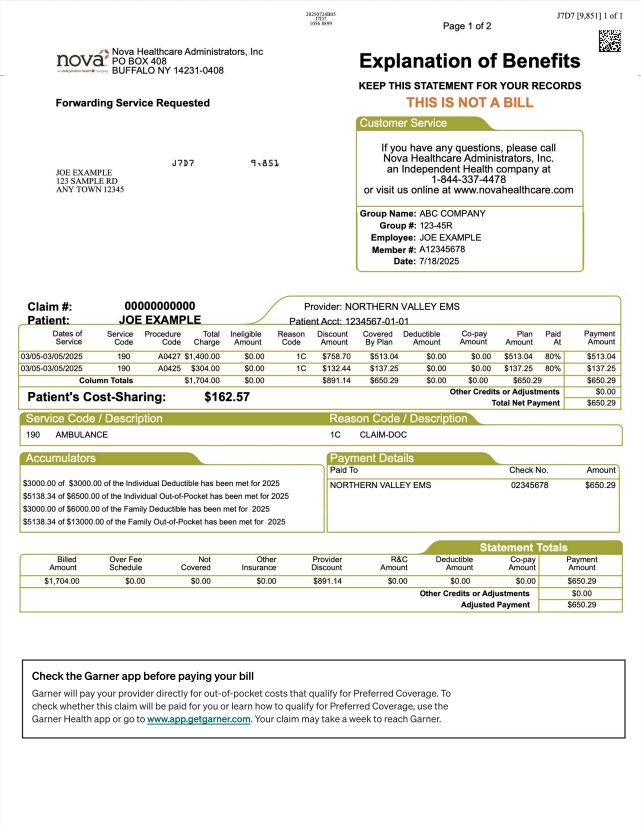

- If you have a patient responsibility, this will be indicated on your Explanation of Benefit (EOB).

- As a reminder, do not pay your physician until you receive the Explanation of Benefits (EOB) from Nova. In some cases, provider invoices are generated before the claims are processed. It is important to wait until the claim has processed to confirm your patient responsibility before paying your bill.

- If a Garner recommended provider bills you at the time of service, please contact the Garner Health Concierge for assistance.

Get Started with Garner

- Visit getgarner.com/signup

- Download the Garner Health app

- Email concierge@getgarner.com, or call 866-761-5147 to locate the top doctors in your area

- Check out the Garner Guide - for general information about the new Garner benefit and to help you with your questions: https://garnerguide.com/jim-ellis.

Centers of Excellence Second-Opinion Program

Garner Health is your first stop to find high-quality providers. The Edison Centers of Excellence program is a voluntary, second-opinion, high-quality resource for specific diagnoses. The Edison Smart Care Centers are available with no member cost for these conditions.

Distance and cost should never get in the way of you receiving the best possible medical care. Our team members who are enrolled in medical will have full access to Edison’s Smart Care Network. All possible barriers have been removed for the best care and all travel expenses will be covered for you and a companion. All team members, spouses, and dependent children who are enrolled in the

medical plan are eligible. This is ZERO COST HEALTHCARE at AMERICA’S BEST MEDICAL CENTERS for the diagnosis types listed below.

- Cancer

- Cardiac

- Transplant

- Pediatric

- Complex Care

Tools & Resources for High-Quality Healthcare

Nova Healthcare

Although the plans includes out-of-network coverage, your costs are significantly reduced if you remain in the Cigna PPO network. You may access Cigna PPO network information as follows:

- www.novahealthcare.com/member

- Find a Provider

- Click on the Cigna Provider directory, select PPO for the plan, and follow search instructions.

OR

Access https://hcpdirectory.cigna.com/web/public/consumer/directory/search or call (855) 206-1040

Nova Explanation of Benefits (EOB)

Access your Nova Explanation of Benefits (EOB) for claim details and deductible and out-of-pocket accumulator information.

Sample ID Card

You will provide your Nova Healthcare ID Card to your Cigna PPO doctor or hospital when you schedule medical care, and pay your copay at the time of service.

New ID Cards will be provided for all medical plan participants for 2026.

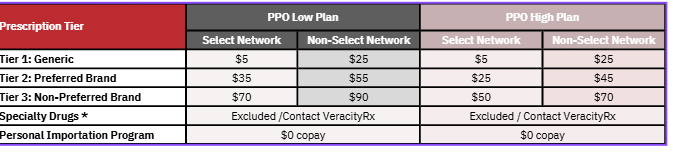

Prescription Drug Coverage

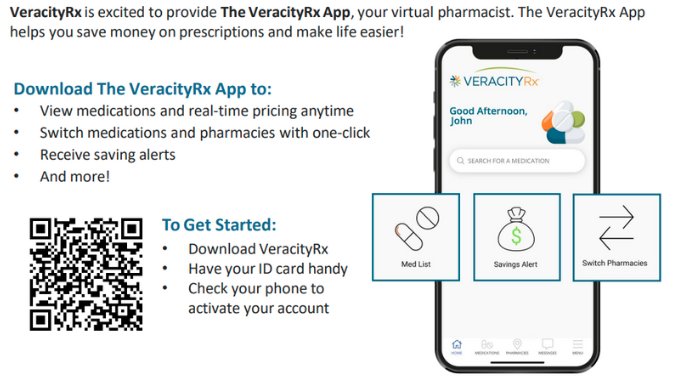

There are some updates to the prescription drug benefit for 2026. VeracityRx is your new pharmacy benefit provider, and VeracityRx will handle your prescription drug claims and customer service. As a reminder, the prescription drug benefit is included in the medical plan out-of-pocket.

The 2026 pharmacy benefit uses a Select / Non-Select pharmacy network. Most pharmacies can fill your prescriptions, but if you use a Non-Select pharmacy, your copay will be higher. Select pharmacies include most pharmacies, while Non-Select pharmacies include CVS, Walgreens, Target, and Rite-Aid.

Retail and 90-Day Supply Benefits

Although the 2026 prescription drug plan does not include a mail order benefit, you can elect to get a 90-day fill at Select pharmacies for 2x the 30-day supply copay. Please note that a 90-day fill is not available at Non-Select pharmacies.

Veracity Rx Mobile App

Personal Importation Program

Certain medications can be obtained internationally from Canada. When medications are obtained this way, the cost to the member is $0 copay. If the member chooses not to participate in the PIP and to fill at a retail pharmacy, the cost to the plan participant is 50% of the cost of the medication and will not apply to the medical plan maximum out-of-pocket.

How to Enroll

- Access veracity-rx.com and complete the Enrollment Form. If you are unable to enroll online, call 888-388-8228.

- Be on the lookout for an email from VeracityRx with next steps.

- Contact your healthcare provider to have a new prescription sent to the pharmacy partner. Instructions will be provided in email on step #2 above.

Specialty Drugs

Although specialty drugs continue to be excluded on your health plan, VeracityRx may be able to help you find the best price for your specialty medications. Contact VeracityRx Pharmacy Services at www.veracity-rx.com for more information.

Pet Insurance

Jim Ellis is offering a new pet insurance benefit for 2026 through Nationwide. Team members enroll in pet insurance directly through Nationwide, and premiums are remitted directly to Nationwide as well. My Pet Protection plan through Nationwide, offers you unmatched flexibility and peace of mind for your furry, feathered, or scaled companions. Plus, since this is offered through your employer, you enjoy discounted premiums.

With My Pet Protection, you have the freedom to use any veterinarian anywhere, at any time, with no need for pre-approvals or restrictive networks. Plans are not limited to dogs and cats; they extend to birds and exotic pets as well. The annual deductible ranges from $100 to $500 with a generous $2,500 or $5,000 annual maximum benefit, which renews in full each year. You may choose coverage for accidents only, or add coverage for illness and/or wellness coverage. Prescription medications for your pets are covered, ensuring they receive the necessary treatments without financial worry.

Choose Your Coverage Level

You may choose your level of desired coverage, based on your specific needs.

Enjoy cashback benefits for a wide range of situations, including accidents, illnesses, hereditary conditions, and more. Whether it's a minor scrape or a major medical issue, My Pet Protection has your pet covered.

- Reimbursement options

- 50%, 70%, and 80%

- Deductible options

- $100, $250, and $500

- Annual maximum benefit options

- $2,500 or $5,000

- Wellness coverage

Coverage Includes:

- Accidents and injuries

- Common illnesses (upset stomach, allergies, etc.)

- Serious illnesses (cancer, diabetes, etc.)

- Surgeries and hospitalizations

- Diagnostic tests (X-rays, MRIs, CT scans)

- Prescription medications, chemotherapy, and therapeutic diets

- Pet Rx Express for prescription medications

- Free, 24/7 access to VetHelpline for guidance on any pet health concern

- Lost Pet (due to theft) benefit

- Death of a pet benefit: $1,000

- Optional wellness coverage with a $450 or $800 annual maximum benefit (no deductible for wellness)

- Multi-pet discounts available

- 2-3 pets: 5% discount

- 4+ pets: 10% discount

Prescription Drug Coverage

- Prescription medication coverage is included with the coverage you select, for any level of coverage.

- You may purchase medications through your vet, or another vendor of your choice (i.e. Chewy).

- If you go through PetRxExpress for your pet's prescription needs, the claim is auto-adjudicated, and your reimbursement will be processed automatically so you don't have to file a claim for reimbursement.

What's Not Covered?

- Boarding

- Grooming

- Pre-existing Conditions: A pre-existing condition is one that was incurred up to 12 months prior to the effective date of coverage.

How to Enroll

There are three simple ways for team members to sign up for their new pet insurance voluntary benefit:

- Visit https://partnersolutions.nationwide.com/pet/jimellis.

- Call 877-738-7874 and mention that you're a team member of Jim Ellis to receive team member pricing.

- Visit PetsNationwide.com or scan the QR code below, and enter your company name.

Digital Resources

View and download team member materials here.

Questions?

Have any questions about your new pet benefit? Reach out directly to cmartinez@nationwide.com.

Flexible Spending Account

A Healthcare Flexible Spending Account (FSA) allows you to use pre-tax dollars to pay for eligible healthcare expenses, saving you money. Your contributions go into your FSA account before federal income or Social Security taxes are withheld. You pay less in taxes, leaving you more disposable income. The IRS manages the guidelines for the FSA plan, so special rules apply.

The Healthcare FSA is available for all benefits-eligible team members, including those not enrolled in the Jim Ellis medical plan. You can use the FSA for your expenses and the expenses of your taxable dependents.

About Reimbursable Expenses

Qualified FSA expenses include a variety of healthcare products and services for you, your spouse, and your taxable dependents. Your FSA may cover medical expenses like copays, deductibles, and coinsurance. Out-of-pocket dental and vision expenses are also eligible for reimbursement. A flyer containing information about eligible expenses is located on the Resources page. www.fsastore.com is also a great resource for eligible Healthcare FSA expenses.

How it Works

The Healthcare FSA allows you to direct a portion of your pay, up to $3,300 for 2025 on a pre-tax basis, into a special account to reimburse yourself for qualifying out-of-pocket expenses. For 2026 the healthcare FSA will have an annual contribution of $3,400. Equal amounts are taken out of each of your paychecks, and your annual FSA contribution is not subject to federal income tax. As you incur eligible expenses during the year, you simply use your debit card or submit the expenses to the administrator for reimbursement. Plan participants pay a $3.50 monthly post-tax administrative fee via payroll deduction.

FSA Debit Card

All FSA plan participants receive a MasterCard debit card which can be used at the time of purchase. The debit card provides a convenient way to pay for eligible expenses, eliminating the need to pay out-of-pocket, file claims, and be reimbursed. Certain vendors may not accept the FSA debit card. In these cases, payment and claim filing for reimbursement is required. All FSA participants are highly encouraged to set-up direct deposit, so that your manual claims may be reimbursed promptly and efficiently. Please refer to the Resources page for the Direct Deposit Authorization Form.

Plan Administration & Receipt Requirements

The Healthcare FSA plan is administered by Medcom. Per IRS regulations, Medcom requires appropriate documentation for all FSA claims, and Medcom may request receipts for debit card transactions. It is very important that all FSA plan participants retain your receipts, per IRS guidelines.

All Healthcare FSA participants have access to your account through the Medcom portal and member app. All participants are encouraged to login to your account and review your balance regularly. If receipts are required, you will be notified on the dashboard of your online portal. The portal and member app are the most efficient way to review your balance, submit documentation, and obtain assistance from Customer Service. Please reference the Resources page for a flyer that explains the online portal.

Use It or Lose It

The FSA plan is governed by the IRS, and special rules apply in exchange for the tax savings. Claims must be incurred by December 31, 2026 to be eligible for reimbursement for the 2026 plan year. The IRS requires that any unused money in your account at the end of the plan year be retained by your employer and forfeited by the team member. However, the IRS allows Healthcare FSA plan members to roll over up to $680 for 2026 of unused funds for future use.

Questions? Call Medcom Benefit Solutions at (800) 523-7542 or the Benefits Service Center at (770) 295-1100.

Sample Debit Card

New Hires

Welcome to the Jim Ellis Automotive Group family. We are very excited to have you on our team and look forward to empowering your success in your new career.

At Jim Ellis, we take pride in caring for our team members, and offer an incredible comprehensive benefits package. Below you will find the following details regarding your initial enrollment into your new benefits plan:

- The Enrollment Process

- Eligibility Information

- The Resources Available To You

Please Note: All team members are required to complete an active enrollment, even if you choose to waive all voluntary benefits. Details on this are below.

START HERE...

If you would like to review our 2026 New Hire Presentation, which reviews all benefits in more detail as well as the information listed below, click here.

If you would like to review our 2026 New Hire Benefits Guide, click here.

Enrollment Process

You will need the following information to complete your enrollment:

- Your name, date of birth, and Social Security Number.

- The name(s), date(s) of birth, and Social Security Number(s) of your dependent children up to age 26 (if applicable).

- Your spouse's name, date of birth, and Social Security Number (if applicable).

- Your current mailing address.

- The full name, address, and date of birth of your life insurance beneficiary (must be at least 18 years old). This is required for all enrollments, as we provide Basic Life Insurance at no cost to you.

For your convenience, we offer 2 ways to enroll in your new benefits:

- By Telephone: Simply call the Benefits Service Center at (770) 295-1100. The Benefits Service Center hours are Monday - Thursday from 8:00 AM - 6:00 PM. Our Benefits Specialists will explain your choices and complete the enrollment for you.

- Online Enrollment: You can access our online enrollment portal here.

- Step 1: Click "Get Started Now". You will be prompted to enter your email address, the last 4 digits of your Social Security Number, and your Date of Birth. You will then be prompted to create a password.

- Step 2: Click "Begin Enrollment" and follow the prompts. For future logins, your User ID will be your email address.

- Step 1: Click "Get Started Now". You will be prompted to enter your email address, the last 4 digits of your Social Security Number, and your Date of Birth. You will then be prompted to create a password.

After you have completed your enollment:

Once you have completed your new hire enrollment, you will receive a confirmation statement. Please review this carefully and contact the Benefits Service Center at (770) 295-1100 if you need to make any changes.

Eligibility Information

Team Member Eligibility:

Team members must work 30+ hours per week to qualify for the benefits package.

You are eligible for benefits on the 1st day of the month following 60 days from your hire date. You must enroll in benefits by the 25th of the month before your effective date.

- Example:

- Hire Date: Jan 15

- 60 Day Mark: March 15

- Enrollment Deadline: March 25

- Benefits Effective Date: April 1

As a New Hire, you can elect up to $200,000 in Life Insurance with No Health Questions. This is referred to as a Guaranteed Issue amount and is only available during your new hire enrollment. Future elections (or increases) will require a health questionnairre to be completed, which will determine your eligibility status.

IMPORTANT: Your voluntary benefits (Medical, Dental, Vision, Voluntary Life Insurance, Disability, Accident, Critical Illness and Identity Theft) will ALL be waived if you do not complete your enrollment.

*Note: The Employee Assistance Program through SupportLinc is available to ALL team members, beginning immediately on your date of hire. More information on this program is available here.

Spouse Eligibility:

- Spouses must be legal spouses to be eligible for benefits

- Same gender legal spouses are eligible

- Common law spouses are not eligible

- Domestic partners are not eligible

- Spouses with other employer-sponsored covereage are not eligible

You will need the following documentation to complete enrollment for your spouse:

- Online Affidavit during enrollment

- Signed Spousal Affidavit

- 2 pieces of Joint Marital Documentaion

- Marriage Certificate +

- Mortgage Statement, Utility Bill, Tax Statement, Bank Statement, etc.

After you have completed enrollment:

- You will receive an email from the Benefits Service Center following enrollment.

- Documentation is due within 30 days of your effective date.

Dependent Eligibility:

- Natural, adopted, and stepchildren are all eligible for benefits up to age 26

- Coverage ends at the end of the month of their 26th birthday

- Grandchildren are not eligible

- Disabled dependent children are eligible with no age limit

Your Resources

You have several Resources available to you regarding your benefits package as well as various company information. Below is a listing of each resource and when to use it.

The Jim Ellis Benefits Website:

On our benefits website, there is detailed information regarding each individual benefit offered to you. This is also where you can access all important documentation related to each, individual benefit. Those documents are located here.

Benefits Service Center:

Our Benefits Specialists are here to assist you with any benefits questions you may have on Monday - Thursday from 8:00 AM - 6:00 PM and on Friday from 8:00 AM - 5:00 PM.

- You can call the Benefits Service Center at (770) 295-1100.

- You can also email the Benefits Service Center at benefits@jimellisbenefits.com

Jim Ellis Team Member Portal:

The Team Member Portal is your online resource for:

- Company events, news, and announcements (located on the Welcome Page)

- Viewing and updating your personal information (address changes, dependent changes, etc.)

- Viewing attendance, paid time off, and sick time

- Viewing and printing benefits forms

- Searching the company directory

- Accessing your Jim Ellis email

- And much more...

To register for the Team Member Portal:

- Visit https://workforcenow.adp.com

- Click on the first bullet point: "First Time Users Register Here"

- When asked for your Registration Code enter: JIMELLIS-ADPNET (registration code is case-sensitive)

- You must register with your full name as it appears on your pay

check. - Please read carefully and select your security questions.

- Enter your contact information accurately so you may receive

emails from the company and your activation code for the

portal from ADP. - After your initial registration, you can access the Portal from

anywhere at anytime, using a laptop, desktop, or mobile device. - If you do not have your own desktop, you can access your Jim

Ellis email through the Portal. A link to the email login screen is

located on the Welcome Page. You are encouraged to check

your email regularly for inter-company communication!

Please direct questions about the Team Member Portal to:

- Mickey Patterson, Portal Administrator

(770) 225-4837

mickeyr@jimellis.com

Telemedicine

The Teladoc telemedicine benefit is available for all full-time, benefits-eligible Jim Ellis team members and your family members. Teledoc’s telemedicine benefit provides 24-hour access to board-certified licensed physicians . This convenient benefit helps you and your family members get the care you need when you need it. Speak with a licensed physician for non-complex medical needs and advice.

All team members access Teladoc through the HealthJoy healthcare guidance app in order to have no consultation fee / no copay at the time of service. If you do not access this benefit through HealthJoy, a consultation fee will apply.

Teladoc members can consult with a physician 24/7/365 by phone, online video, or mobile app from anywhere. You can get advice and treatment for non-emergency medical concerns. You can also use Teladoc for medical advice and care in the following situations:

- When your primary care physician is not available or accessible.

- After normal business hours, nights, and weekends.

- When you are at home, traveling, or don’t want to take time off work for a doctor’s appointment.

- When you need a prescription refill (not all scripts will be filled by your Teledoc physician).

Consult Fees

$0 consult fee for general medical appointments if accessed through HealthJoy.

Download the HealthJoy app for access today!

Common Medical Conditions Treated

- Allergies

- Bronchitis

- Sinus issues

- Cold / flu

- Headaches / migraines

- Respiratory infections

- Stomach ache and diarrhea

- Urinary tract infections

- And more

Benefits of Using Teladoc

- Quicker recovery

- Save time and money

- Choice of consultation method

- Convenient prescriptions

Reasons to Use Teladoc

How to Access Coverage

Medical Plan Participants

Access Teladoc through the HealthJoy portal at www.healthjoy.com

Employee Assistance Program

Jim Ellis is pleased to provide the SupportLinc Employee Assistance Program (EAP) for all team members (including part-time team members) that you can use upon your date of hire with no waiting period. SupportLinc offers expert guidance to help address and resolve everyday issues. Click here to watch a video for more information on this valuable new program: SupportLinc EAP Overview Video.

What Is SupportLinc?

Designed to help you manage life’s challenges as well as balance home and work, SupportLinc is a no-cost, confidential program available to you and your family members. Licensed counselors are available 24 hours a day, 365 days a year, for support, guidance, and referrals to help you resolve a broad range of concerns.

For additional information regarding the SupportLinc EAP program, please register and watch this recorded webinar.

From the everyday issues like job pressures, anxiety, relationships, financial pressures, personal grief, loss, or a disability, SupportLinc can be your resource for professional support. You and your benefit eligible family members can access this program at any time.

The service includes in-the-moment support, and up to 8 face-to-face or virtual sessions per issue per year, so each member of your family can get counseling help for their own unique needs. Text therapy is also available. 1 week of text therapy would count as one session, so up to 8 weeks of text therapy is available.

Important Notes

SupportLinc Employee Assistance Program (EAP) is available whenever is most convenient for you, to address anxiety, work-related pressures, relationships, home responsibilities, substance abuse, and much more.

- Call (888) 881-LINC (5462) for in-the-moment support from a licensed clinician 24/7/365

- Visit the web portal, www.supportlinc.com, to learn more about video coaching, text therapy, and self-guided resources

- Use Live Chat on desktop or mobile

- Email a question to support@curalinc.com

- Up to 8 face-to-face or virtual sessions per issue per year including clinical and coaching

- Text therapy: up to 8 weeks per issue per year

Information and help are free and completely confidential. You can contact the SupportLinc program 24 hours a day, 365 days a year. To get started, call (888) 881-5462, or log in to the SupportLinc web portal or eConnect® mobile app with group code: jimellisautomotivegroup.

Services Available

Information and help are free and completely confidential. You can contact the SupportLinc program 24 hours a day, 365 days a year. To get started, call 1-888-881-5462, or log in to the SupportLinc web portal or eConnect® mobile app with group code: jimellisautomotivegroup.

Identity Theft

Every 2 seconds, thieves steal another identity. Your identity includes more than your Social Security Number and bank accounts. The Allstate Identity Protection Pro Plus Plan does more than monitor your credit reports and scores. It safeguards your personal information and the data you share. Allstate Identity Protection gives you the tools and protection to monitor activity, stop identity theft early, and resolve it quickly. Most victims only discover they have a problem when they are denied credit or receive bills for items never ordered. We encourage you to consider this benefit as a proactive step to help protect your personal information.

The Allstate Identity Protection plan has extensive protection for you and your family.

Identity Theft Protection is designed to help you regain control of your name and finances after identity theft occurs. Trained counselors walk you through the process of remediating any damage. They help you write letters to creditors and debt collectors, place a freeze on your credit report to prevent an identity thief from opening new accounts in your name, and guide you through the restoration process. Benefits include but are not limited the below.

Identity Theft

- Proactive Credit Monitoring

- Credit Score Tracking

- Social Media & Dark Web Monitoring

- Student Loan Activity Alerts

- Lost Wallet Protection

- Data Breach Notifications

- Credit Freeze & Dispute Assistance

- IP Address Monitoring

- Deceased Dependent Protection

- 24 / 7 Remediation Support

- Allstate scam protection, including alerts and education

- Child credit checks

- ID restoration support such as one-to-one coaching, Identity Fraud Finder, and specialist chat

- Financial transaction monitoring

- Identity health status tool, helping members understand their risk level and identity health

- Allstate Security Pro with personalized content about heightened security risks

- Up to $1m reimbursement for stolen funds and up to $2m for many out-of-pocket costs related to resolving their case

- Including home title fraud and professional fraud

- Stolen funds from SBA loans, stolen tax refunds, and more

- Allstate Digital Footprint, showing members where their personal information lives and is stored online

- Solicitation reduction, allowing members to easily opt in or out of the National Do Not Call Registry, credit solicitations, and junk mail reduction

- Sex offender notifications

- Robocall blocker, to help intercept scam and telemarketing calls and texts

- Ad blocker

- Unemployment fraud center with dedicated support

- Elder fraud center

- Mental health support, with free access to Talkspace Go for family members and their loved ones

- Family digital safety tools

Mobile App Included

The Allstate Identity Theft Protection app makes accessing the member services portal easy anywhere. Available on iOS and Android.

Employment Termination of Coverage

Your Identity Theft plan will terminate on the last day of the month in which your employment termination occurs. This means that your coverage will conclude at the end of that specific month.

Wellness

Employee health and wellness is a priority for Jim Ellis. The Jim Ellis Wellness Program is designed to help you improve your health with incentives when you complete simple tasks. When you comply with the requirements by the due date, you avoid potential surcharges.

Surcharges are deducted post-tax on a quarterly basis. Upon compliance, the surcharges are discontinued at the beginning of the following quarter of compliance.

Avoiding the Tobacco Surcharge

To avoid the separate $25 per month surcharge, you must complete the non-tobacco affidavit or be an active participant in tobacco cessation by the deadline.

- Obtain the non-tobacco affidavit from the Resources page or Human Resources.

- Complete and sign the affidavit within 60 days of your benefits effective date (or by the annual due date) to avoid the surcharge.

- Submit the affidavit to Yvonne Teague in Human Resources to ensure it is processed timely.

If you use tobacco products and participate in the smoking cessation program, the tobacco surcharge is waived. Free tobacco cessation program is offered through Truth Initiative and more information on this will be coming soon.

Note: Tobacco products include all forms of tobacco, including but not limited to cigarettes, e-cigarettes containing nicotine, vapes containing nicotine, and chewing tobacco.

Gym Membership

Disability

Anthem/Greater Georgia Life is now Standard Insurance Company.

Disability coverage provides an income replacement benefit in the event you are unable to work due to an illness or accident and become disabled. Up to 1 in 4 (27%) of adults in the U.S. have some type of disability.

Short-Term Disability (STD) provides a benefit to replace a portion of your income for a short period of time. The benefit amount is 60% of your earnings and the benefit duration is 13 weeks.

Long-Term Disability (LTD) pays you an income benefit every month up to age 65 as long as you remain disabled. The benefit amount for LTD coverage is also 60% of your earnings.

Should you choose not to elect LTD coverage as a new hire, underwriting approval and an Evidence of Insurability (EOI) form will be required for future elections. Team members should select Voluntary Long Term Disability when completing the EOI Form. There is no EOI requirement for future election of Short Term Disability.

Pre-Existing Conditions

Pre-Existing Condition Exclusion

The Short Term Disability plan pays a limited benefit for disabilities caused by pre-existing conditions. A pre-existing condition is an injury or illness for which you had testing or treatment during the 12 months prior to the date on which you became insured under the policy. This exclusion does not apply if your disability begins after you’ve been insured under the policy for at least 12 months.

The Long Term Disability plan pays a limited benefit for disabilities caused by pre-existing conditions. A pre-existing condition is an injury or illness for which you had testing or treatment during the 12 months prior to the date on which you became insured under the policy. This exclusion does not apply if your disability begins after you’ve been insured under the policy for at least 24 months.

| Short-Term Disability | Summary of Benefits |

|---|---|

| Benefit Amount | 60% of weekly earnings |

| Maximum Weekly Benefit | $500 (tax-free) |

| Maximum Benefit Period | 13 weeks |

| Benefits Begin |

1st day due to injury

8th day due to illness |

| Long-Term Disability | Summary of Benefits |

|---|---|

| Benefit Amount | 60% of monthly earnings |

| Maximum Weekly Benefit | $5,000 (tax-free) |

| Maximum Benefit Period |

To age 65 or Social Security

Normal Retirement Age |

| Benefits Begin | 91st day of disability |

Employment Termination of Coverage

Disability coverage ends on your date of employment termination.

Accident

Jim Ellis offers an accident plan through Voya Financial to protect you from unexpected non-occupational accidents, as it can be difficult to financially plan for the unexpected. This plan provides a benefit payable according to a schedule, and the funds may be used for any purposes, including helping to pay for medical out-of-pocket costs like deductibles and coinsurance. The expenses must result from a non-occupational / non-work related accidental injury.

This plan reimburses you for your medical expenses according to the schedule and the benefit is paid directly to you. Coverage options are available for you, your spouse, and your dependent child(ren). It also includes a benefit for death, loss of limbs, hospital visits, and transportation by ambulance – as a result of a covered accident. Reference the plan summary below for more details.

| Injury | 2024 Benefit | 2025 Benefit |

|---|---|---|

|

Hospital Care

|

||

| Surgery - Open abdominal, thoracic | $1,000 | $1,200 |

| Blood | $500 | $600 |

| Admission | $1,125 | $1,500 |

| Confinement | $350 / day up to 365 days | $350 / day up to 365 days |

| Transportation | $650 / trip up to 3 per accident | $750 / trip up to 3 per accident |

| Lodging | $150 / day up to 30 days | $180 / day up to 30 days |

|

Accident Care

|

||

| Initial doctor visit | $75 | $100 |

| Urgent care | $200 | $225 |

| Follow-up doctor treatment | $75 | $100 |

| Medical equipment | $100 | $200 |

| Speech & physical therapy | $40 up to 6 per accident | $50 up to 10 per accident |

| X-Ray | $40 | $75 |

|

Common Injuries

|

||

| Burns: 2nd and 3rd degree | $1,125 to $12,500 | $1,250 to $15,000 |

| Emergency dental work | $75 to $300 | $90 to $350 |

| Eye injury | $80 to $275 | $100 to $350 |

| Torn knee cartilage | $175 to $650 | $225 to $800 |

| Lacerations | $25 to $400 | $30 to $480 |

| Tendon, ligament, rotator cuff | $350 to $1,000 | $425 to $1,225 |

| Concussion | $175 | $300 |

| Paralysis | $13,500 to $20,000 | $10,000 to $24,000 |

|

Injuries - Dislocations

|

Non-surgical | Surgical | Non-surgical | Surgical |

| Hip joint | $3,200 | $6,400 | $3,850 | $7,700 |

| Knee | $2,000 | $4,000 | $2,400 | $4,800 |

| Ankle or foot bones (other than toes) | $1,200 | $2,400 | $1,500 | $3,000 |

| Shoulder | $1,500 | $3,000 | $1,600 | $3,200 |

| Elbow, wrist | $900 | $1,800 | $1,100 | $2,200 |

| Finger / Toe | $250 | $500 | $275 | $550 |

| Hand bones (other than fingers), lower jaw, collarbone | $900 | $1,800 | $1,100 | $2,200 |

| Partial dislocations | 25% of the non-surgical benefit | 25% of the non-surgical benefit |

|

Injuries - Fractures

|

Non-surgical | Surgical | Non-surgical | Surgical |

| Hip | $2,500 | $5,000 | $3,000 | $6,000 |

| Leg | $1,800 | $3,600 | $2,500 | $5,000 |

| Ankle, hand, wrist | $1,500 | $3,000 | $1,800 | $3,600 |

| Collarbone | $1,200 | $2,400 | $1,440 | $2,880 |

| Rib(s) | $350 | $700 | $400 | $800 |

| Shoulder | $1,500 | $3,000 | $1,800 | $3,600 |

Important Notes

- Team members are eligible regardless of age

- Spouses age 70 and older are not eligible to elect coverage. For 2025 coverage, this does not apply.

- Coverage for eligible child dependent(s) is up to age 26

Sports Accident Coverage

The Voya Accident plan pays an additional 25% of the Hospital Care, Accident Care, and Common Injuries benefits to a maximum of $1,000 if the covered accident is as a result of an organized sporting activity.

How to File a Claim

• Go to voya.com/claims.

• Select “Get Started” and then click “Let’s Get Started.”

• Click the button beside “Policyholder,” and then select who the claim is for.

• Click “Continue” and enter the required information.

• Your Group Name and Number are: Jim Ellis Automotive Group | 70271-4

Exclusions

All sicknesses including pregnancy, work-related injuries, services not medically necessary, being intoxicated in accordance with state laws, alcoholism, voluntary inhalation of gas/fumes/taking of poison, driving in any race or speed test or while testing an automobile or vehicle on any racetracks or speedway, injury while skydiving, hang gliding, parachuting, scuba diving, rodeo, or aviation except flight in a scheduled passenger aircraft, being under the influence of a narcotic/drug, intentionally self-inflicted injury, hernia, carpel tunnel syndrome, or any complication therefrom, bacterial infections.

Employment Termination of Coverage

Your Voya Accident plan will terminate on the last day of the month in which your employment termination occurs. This means that your coverage will conclude at the end of that specific month.

Critical Illness

Jim Ellis offers a Critical Illness benefit through Voya Financial that provides a monetary benefit to help with the out-of-pocket medical and non-medical expenses upon diagnosis of a covered illness. Critical Illness insurance helps you and your family maintain financial security during the recovery period of a serious medical event, such as cancer, heart attack, or stroke. This plan pays a benefit if the initial diagnosis for a covered illness is while the certificate is in force. (See certificate for complete details.)

Coverage amount for team members and spouses are available in $5,000 increments, as follows:

Team Member: $5,000 to $30,000

Spouse: $5,000 to $15,000

Child(ren): $1,000, $2,500, $5,000 or $10,000

The team member must be enrolled in coverage to elect spouse or child coverage, but the spouse coverage level cannot exceed the coverage elected on the team member. There are no health questions when enrolling in this benefit, but the benefit will reduce by 50% at age 70 for both team members and spouses. Additional information on the plans is below.

Features

-

Benefits are paid in addition to any other insurance that you may have, and benefits are paid directly to you

-

This plan pays a benefit if the initial diagnosis for a covered illness is while the certificate is in force. (See certificate for complete details.)

-

-

This product could pay multiple times for the same or different covered conditions (see the certificate on the Resources page for additional information)

-

Benefits may be used however you'd like. Typical uses include:

-

Out-of-pocket medical and non-medical expenses

-

Home health care needs and home modifications

-

Recovery and rehabilitation

-

Child care or caregiver expenses

-

Travel expenses to and from treatment centers

-

Wellness Benefit Included

The voluntary Critical Illness plan includes a wellness benefit for covered preventive screenings, including but not limited to:

- Chest X-Ray

- Mammogram

- Hemocult

- Colonoscopy

- CA 125 and CEA blood tests

- Prostate specific antigen testing

- Pap Smear

2025 Wellness Benefit Amount

- Team member: $75

- Spouse: $75

- Child(ren): $75 per covered child, per calendar year

How to File a Claim

- Go to voya.com/claims.

- Scroll down to the “Have a Wellness Benefit Claim?” section and click the “Start your claim” button.

- Select “Policyholder” and complete the information requested.

- Your Group Name and Number are: Jim Ellis Automotive Group 70271-4

| Covered Diagnoses |

|---|

| Cancer (see certificate definition) |

| Carcinoma in situ (limited benefit) |

| Heart attack |

| Stroke |

| Major organ failure |

| End state renal (kidney) failure |

| Permanent paralysis |

| Coma (see certificate definition) |

| Coronary artery bypass surgery (limited benefit) |

| Deafness, blindness |

| Benign brain tumor |

| Occupational HIV |

| Enhanced 2025 Covered Diagnoses and Enhancements |

|---|

| Carcinoma in Situ (50%) |

| Coronary Artery Bypass (100%) |

| Sudden Cardiac Arrest |

| Type 1 Diabetes |

| Severe Burns |

| Transient Ischemic Attacks (10%) |

| Ruptured or Dissecting Aneurysm (10%) |

| Abdominal Aortic Aneurysm (10%) |

| Thoracic Aortic Aneurysm (10%) |

| Open Heart Surgery for Valve Replacement or Repair (25%) |

| Transcatheter Heart Valve Replacement or Repair (10%) |

| Coronary Angioplasty (10%) |

| Implantable (or Internal) Cardioverter Defibrillator (ICD) Placement (25%) |

| Pacemaker placement (10%) |

| Bone marrow and stem cell transplant (50%) |

| Multiple Sclerosis |

| Amyotrophic Lateral Sclerosis (ALS) |

| Parkinson's Disease |

| Advanced Dementia including Alzheimer's Disease |

| Huntington's Disease |

| Muscular Dystrophy |

|

Infectious Disease (Hospitalization Requirement - 25%) Additional Infectious Condition Diagnosis Benefit - $100 Additional Infectious Condition Hospital Confinement Benefit - $1,000 |

| Addison's Disease (10%) |

| Myasthenia Gravis (50%) |

| Systemic Lupus Erythematosus (50%) |

| Systemic Sclerosis - Scleroderma (10%) |

| 2025 Covered Conditions for your insured children: |

|---|

|

Cerebral Palsy, Congenital Birth Defects, Cystic Fibrosis, Down Syndrome, Gaucher Disease - Type II or III, Infantile Tay Sachs, Niemann-Pick Disease, Pompe Disease, Type IV Glycogen Storage Disease, Sickle Cell Anemia, Type 1 Diabetes, Zellweger Syndrome |

Employment Termination of Coverage

Your Critical Illness policy will terminate on the last day of the month in which your employment termination occurs. This means that your coverage will conclude at the end of that specific month.

Life Insurance

Anthem/Greater Georgia Life is now Standard Insurance Company.

In order to provide you and your family with financial protection in the event of your death, Jim Ellis provides Basic term life insurance and Accidental Death and Dismemberment coverage, or AD&D. If you die as a result of an accident, the plan also pays either the amount of your life insurance or a percentage for loss of limbs, speech, hearing, and more.

Voluntary Term Life is also available and provides the opportunity to supplement the life benefit provided by Jim Ellis. You may want to consider purchasing additional life insurance at favorable group rates.

Beneficiaries

You will be required to provide your beneficiary information at the time of your enrollment. A beneficiary is a person who would receive your life insurance benefit in the event of your death.

Evidence of Insurability (EOI)

As a new hire, you are able to elect up to the Guarantee Issue of $200,000 for yourself and $50,000 for your spouse with no health questions. Should you wish to elect an amount that exceeds the Guarantee Issue, an Evidence of Insurability Form is required. You may obtain an EOI Form from the Resources page or by calling the Benefits Service Center. Most new and additional elections at Annual Open Enrollment also require an Evidence of Insurability (EOI). To apply, simply complete the form and submit it to Standard Insurance Company for review. You will not be deducted for your pending amount unless / until you are approved.

Important Notes

- There is no age cap to be eligible to enroll

- Spouse life cannot exceed 50% of team member amount

- Spouse premiums are based on the spouse's age

- Child(ren) can be covered until age 26

- Beneficiary information is required upon enrollment

- Accidental Death and Dismemberment (AD&D) coverage is included

- Benefit is doubled in the event of death due to accident

- If you are below age 60 and diagnosed with a terminal illness with a life expectancy of less than 12 months, you may collect 75% of your life insurance benefit, up to $250,000, prior to your death. See certificate for details.

Maximums and Age Reductions

Plan Maximums

Team Member Life: Up to 5x earnings in $10,000 increments to a maximum of $500,000

Spouse Life: Up to 50% of team member amount in $5,000 increments to a maximum of $100,000

Child Life (15 days to Age 26): $10,000 coverage up to age 26

Guarantee Issue Amounts

Team Member Life: $200,000

Spouse Life: $50,000

Child Life: $10,000

Age Reductions

The team member and spouse voluntary life benefits reduce to 65% of original benefit following your 65th birthday and to 50% of original benefit following your 70th birthday. The change will take place on January 1 following the birthdays.

Employment Termination of Coverage

Your life insurance coverage plan will cease on your termination date. You will have the opportunity to convert your Basic Employer-Paid Life Insurance and Group Voluntary Team Member-Paid Life Insurance policy into an individual policy. To do so, you must complete a portability application within 30 days from your employment termination date.

This option allows you to maintain life insurance after your employment ends. Contact the Benefits Service Center at (770) 295-1100 for additional information regarding the portability process.

Vision

The Anthem vision plan provides a benefit for an eye exam, eyeglass frames, and contact lenses or eyeglass lenses. If you visit an in-network provider, you pay a copay for your standard eye exam, and the plan pays a benefit of up to $250 for frames and contact lenses. There are additional copays and costs that could apply for a contact lens exam and eyeglass lens options. With the Anthem vision plan, you may visit any vision provider. However in order to maximize your vision benefit, we encourage you to visit an in-network provider.

Frequency limitations: The exam benefit, lenses benefit, and frames benefit are all once per calendar year. Either the eyeglass benefit or the contact benefit may be used in the same benefit period.

Participating vision provider information can be found on the Resources page.

| Vision Summary of Benefits | In-Network |

|---|---|

|

Eye Exam

|

|

| Standard | $20 copay |

|

Eyeglass Lenses

|

|

| Single | $20 copay |

| Bifocal | $20 copay |

| Trifocal | $20 copay |

| Lenticular | $20 copay |

|

Lens Options

|

|

| Transitions (children to age 19) | $0 copay |

| Standard Polycarbonate (children to age 19) | $0 copay |

| Factory Scratch Coating | $0 copay |

| Standard Progressive | $65 copay |

| UV Coating | $0 copay |

| Standard Polycarbonate (Adults) | $40 copay |

|

Eyeglass Frames

|

Plan pays $250 less $20 copay, then 20% off balance Additional pairs: 40% discount |

|

Contact Lenses

|

|

| Conventional & Disposable | $250 allowance, then 15% off balance |

| Medically necessary (see definition below) | Covered in full |

Frequencies

- Exam: Once per calendar year

- Lenses: One pair per calendar year

- Frames: One pair per calendar year

The plan covers either contact lenses OR eyeglass lenses once per calendar year.

Medically Necessary Definition and Process

The definition of medical necessity for vision coverage is as follows:

- Non-elective (medically necessary) contact lenses are prescribed by a doctor solely for purposes of correcting a specific medical condition that prevents your vision from being corrected to a specified level of visual acuity using conventional eyeglasses. Choosing contacts over glasses for a standard prescription is considered elective/cosmetic.

- Medically Necessary: Contact lenses that are applied to meet the requirements related to eye conditions. These eye conditions prevent the member from achieving a specified level of visual acuity with conventional spectacle lenses; the contact lenses may be any modality (soft conventional, soft disposable gas permeable, etc.) depending on the eye condition and the recommendation of the provider.

The provider provides an examination, and if the member has qualifying conditions that determine the member to be qualified for medically necessary contacts by the provider, then the in-network provider submits a preauthorization. The preauthorization process is not a pre-approval process; it is an eligibility review. The preauthorization will be screened and sent to the National Optometric Director for approval. Upon approval the provider will need to submit both the claim, preauthorization, and approval for processing.

Employment Termination of Coverage

Your vision insurance coverage will conclude on the last day of the month in which your employment termination takes place.

Your vision coverage is a COBRA eligible benefit. Under COBRA regulations, you have the opportunity to extend your vision benefits for up to a maximum of 18 months from the date your coverage ends. This enables you to maintain access to the same vision benefits you enjoyed as an active Jim Ellis team member.

Following your employment's conclusion with Jim Ellis, you will receive a comprehensive COBRA continuation notice with details on how to continue your vision coverage through COBRA.

Dental

Jim Ellis offers a comprehensive dental plan with an extensive network of dentists through Anthem. We encourage you to use network dentists in order to help manage the long term costs of the dental plan and reduce your out-of-pocket costs.

The Anthem dental plan provides coverage both in and out-of-network. However, you will make the most of your dental plan benefits if you visit participating Anthem dentists. We encourage you to use a participating dental provider to reduce your out-of-pocket costs and help manage the long term costs of the plan. Participating dentist information can be found on the Resources page.

Below is a benefit summary of your annual deductible and co-insurance costs.

|

Calendar Year Deductible

|

$50 individual | $150 Family

Does not apply to preventive or orthodontic care |

|---|---|

|

Calendar Year Maximum

|

$5,000 |

|

Orthodontia: Children to age 19 only

|

Plan pays 50%

$1,000 lifetime maximum |

|

Preventive Care (Deductible Waived):

|

Plan pays 100%

Exams and cleanings: 2 per 12 months Fluoride: 2 per 12 months (children under age 16) Bitewing x-rays: Once per calendar year Full mouth x-rays: Once per 5 years Bitewing x-rays: Once per calendar year |

|

Type B - Basic Services (After Deductible):

|

Plan pays 80%

Sealants: Once per 3 years (children under age 16) Space maintainers: Once per 5 years (under age 16) Amalgam and composite fillings: once per tooth per 2 years |

|

Type C - Major Services (After Deductible):

|

Plan pays 50%

Oral surgery: Simple and surgical extractions Root canal Periodontal maintenance and surgery Scaling and root planing Crowns, dentures, and fixed bridges Inlays / Onlays Implant services |

| Please refer to the Certificate for a complete listing of covered services and frequency limitations. |

Important Notes

-

No age limitations for coverage

-

$50 team member deductible / $150 family deductible (waived for preventive and orthodontic care)

-

100% Preventive Coverage / 80% Basic Coverage / 50% Major Services

-

Members utilizing participating dentists will enjoy discounted dental fees in addition to protection from balance billing for charges above the dentist’s maximum allowable charges. Members utilizing non-participating dentists will have the same benefits but may be subject to balance billing.

Finding a Provider

Access www.anthem.com and select "Find Care" and then either login or select "Guest." Select “Dental” for type of care, and then select “Georgia” in the drop down. Select “Dental” for the type of plan, and then “Dental Complete” for the plan / network.

Unique Plan Features

Your dental plan through Jim Ellis includes:

- Accidental Injury Benefit - coverage at 100%, no deductible or coinsurance up to the dental plan annual maximum.

- Online resources: “Ask a Dental Hygienist” and Cost Estimator tool

- Benefits such as extra cleanings, gum maintenance, fluoride, sealants, and more for members with certain health conditions.

- International Emergency Dental Program: 100% coverage for emergency dental services while traveling abroad.

Claims Process

In-Network

- Participating dentists file the claim and accept payment from Anthem

- Team members should not need to pay at the time of service for participating providers

Out-of-Network

- For out-of-network dentists, if the dentist does not agree to file the claim as out-of-network with Anthem, team member pays at the time of service and files a claim for reimbursement

- Charges by out-of-network providers that exceed Usual & Customary charges are the member’s financial responsibility. (Member pays the difference between the actual charge and the plan’s U&C reimbursement level.)

Employment Termination of Coverage

Upon your employment termination, it's important to understand how your dental plan coverage will be affected.

Your dental plan coverage will end on the last day of the month in which your employment termination occurs.

Your dental coverage is a COBRA eligible benefit. Under COBRA regulations, you have the option to extend your dental benefits for a maximum period of 18 months from the date of your coverage ending. This allows you to maintain access to the same dental benefits you had as an active team member.

Following your end of employment with Jim Ellis, you will receive a comprehensive COBRA continuation notice. This notice will provide you with additional details and instructions on how to proceed with continuing your dental coverage under COBRA.